The first thing to understand is that each state has its own rules and requirements. Certain things are universal, based on the U.S. Constitution and other issues can vary from place to place.

No state can prevent you from incorporating a business in another state. The only thing your state can control is whether you are required to file a tax return in your state and if so, how much of your total profit is subject to income tax in your state.

That is a matter to be discussed with an accountant and possibly a tax attorney. We are neither. We do not offer legal or accounting advice. What we provide is just general outline info, based on the most commonly asked questions.

If you have a physical location and employees and even inventory, it would be much more complicated to avoid paying taxes on profits earned in the state where those assets are. But there are other reasons for incorporating in friendly states. The cost of the incorporation can be much cheaper and the yearly fees can be much cheaper. Additionally, certain states maintain a level of privacy, while others do not.

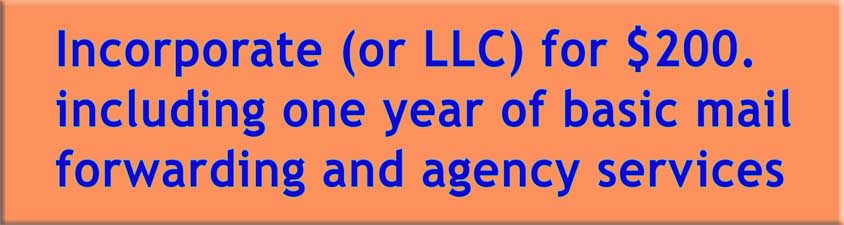

We can show you how to set up a new corporation or LLC in a friendly state for a total of $200., which includes a business address, one year of basic mail forwarding and local agency representation. Thereafter, the yearly renewal is roughly half that much.

Please send us an email to: Incorporate@LegalSupportOnline.com

and we will immediately email you back additional instructions and all the information. We only ask that if you are pleased with your new company formation, you send us a $50.00 donation by PayPal (which is included in the $200. total. This would be on the honor system). The link to our paypal account will be in the email or can be found below or on our home page.

(Please provide your name and state where you live in your email)

You can also use the form below to message us, but it may take longer for us to reply.

Use of this site acknowledges acceptance of Terms of Service

See our Privacy Policy

Copyright 2023 Quantum Vector Int.